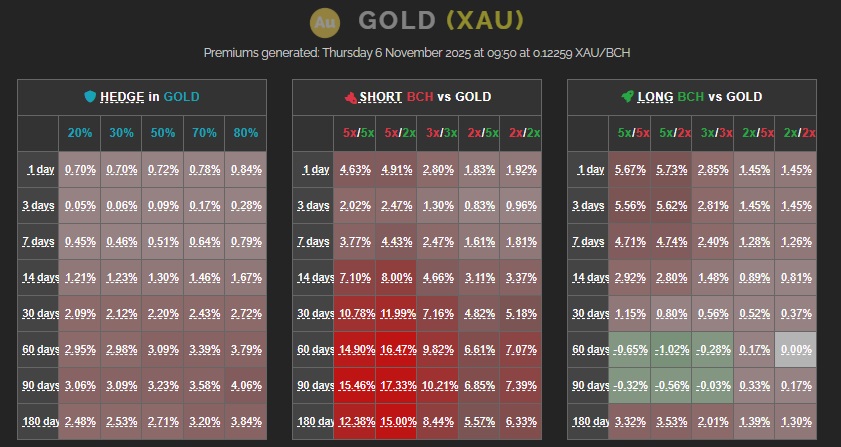

The live BCH Bull Premiums Table is a simple way to see market balance in real time. Learn what each grid means, how to read the colors, and when to act.

1. Know the layout

Each market is shown as three side by side grids:

- Hedge in [asset]. Columns are protection levels such as 20%, 30%, 50%, 70%, 80%.

- Short BCH vs [asset]. Columns are contract choices such as 5x/5x, 5x/2x, 3x/3x, 2x/5x, 2x/2x.

- Long BCH vs [asset]. Same contract choices as short.

Each row represents the length of the contract, with common contract lengths displayed including 1 day, 3 days, 7 days, 14 days, 30 days, 60 days, 90 days, and 180 days.

2. Read the colors

- Green numbers. These show a negative premium, meaning you actually receive BCH from the liquidity provider when opening the position. It indicates that market demand is tilted in your favor, so you’re being paid to take that side of the contract.

- Red numbers. These show a positive premium, meaning you pay BCH to open the position. This usually happens when there’s higher demand for that side of the market, so entering costs a little extra.

Deeper color means a stronger premium. Pale cells are near neutral.

3. Timing entries

Treat premiums as signals, not as guarantees. Two quick examples:

- Hedger example. You see a small green premium on a 30 day hedge. You lock stability and receive BCH at entry. Good fit if you want on chain certainty.

- Trader example. A 5x long still shows a red premium, but it has improved from earlier levels and is now within a reasonable range to enter. And since premiums on BCH Bull are fixed once you open the contract, you know your exact cost upfront, unlike other platforms where funding fees keep changing over time.

4. Combine with price context

Watching premiums together with price gives more insight than either alone. If price drifts down while long premiums soften toward green, sentiment may be rotating. If price spikes and hedge premiums turn red across many expiries, demand for protection is rising.

5. Update frequency

Premiums refresh regularly. If you return later and the colors have shifted, that reflects new market balance. Use the timestamp to confirm recency and reload once if you suspect an older cache.

6. Things to keep in mind

- Look beyond the color. A green premium can be attractive, but timing and market context matter more than the color alone.

- Check your contract length and size. Shorter contracts or smaller positions often have very different premiums than long-term or high-leverage setups.

- Remember it’s fixed. Once you open a position, the premium never changes, so your cost or payout is locked in from the start.

- Watch liquidity flow. Premiums reflect balance between hedgers and traders. A sudden shift in color across the table often signals changing sentiment.

7. Tips for power users

- Compare across fiat pairs. If your goal is simply to trade BCH against fiat, check all available fiat pairs from USD, EUR, INR, and CNY, to spot where the best premium currently lies.

- Use the color scale as a signal, not a trigger. Consistent green or red zones can reveal market trends across durations or assets.

- Click a premium cell. It instantly opens the BCH Bull app with those parameters preloaded so you can inspect and confirm before acting.