What are premiums on BCH Bull?

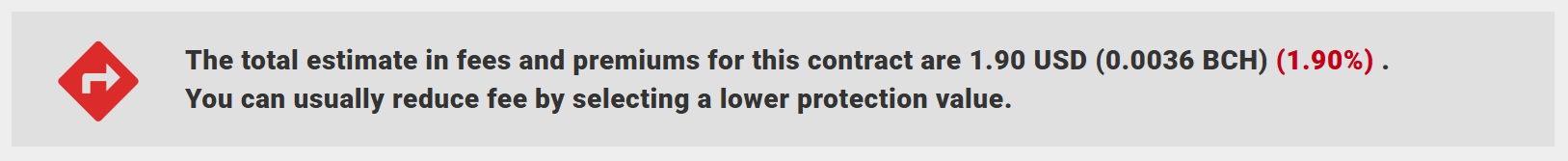

When you propose a contract on BCH Bull (after entering your contract parameter details), you'll see a dynamically changing notification bar at the end of your proposal like this:

If it’s red (positive), you are paying to create your proposed contract. If it’s green (negative), you are actually getting paid to create your contract position.

The quote you see is made up of two parts: fees and premiums. The fee comes from the settlement service provider and is always a cost you pay when creating a contract. The premium comes from the liquidity provider (LP) and changes with market conditions. It can move in either direction, red when you pay it or green when you receive it.

This estimate updates instantly whenever you adjust your contract parameters. The LP sets the premium based on current market balance. Sometimes the LP charges a premium (red/positive) for opening a position, and other times the LP offers a premium (green/negative), meaning you get paid to open your contract.

How are premiums different on BCH Bull compared to other DeFi platforms?

On most DeFi platforms that offer leverage or perpetual contracts, the fees you pay are constantly changing. Funding rates move up and down based on open interest, market imbalance, and time held. This means you never truly know your final cost until after the position is closed. Even when the interface looks simple, the underlying calculations are complex, and traders often find their results differ from what they expected.

BCH Bull works very differently. The premium is fixed and fully transparent from the moment you create a contract. You see the number clearly before confirming, and it never changes for the life of that contract. There are no hidden adjustments, no hourly funding payments, and no moving targets. Once the contract begins, your position is locked, clear, and easy to track.

Another unique feature of BCH Bull is the possibility of green premiums. Instead of paying to open a position, you can sometimes be paid by the liquidity provider to create your contract. This is not a bonus or rebate; it reflects genuine market conditions where liquidity flows in your favor.

BCH Bull also makes premiums measurable and visible. The Premiums Table updates in real time, showing the current state of every market pair. You can monitor trends, see which side is offering value, and track how the liquidity provider is moving between red and green over time. This level of openness is rare in DeFi and makes BCH Bull both predictable and transparent for every user.

How can I see current premiums?

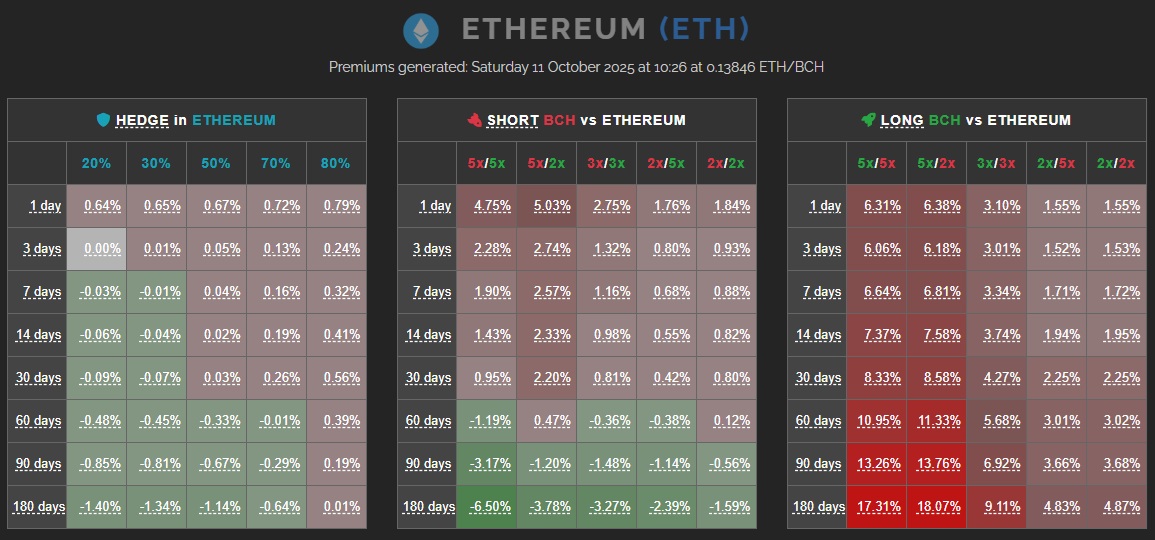

You can check live premiums on the Premiums tracker page. It shows a set of tables for each market so you can compare hedging and leverage opportunities in one place.

Each asset market section has three grids. On the left you will see Hedge in [asset] with columns for protection levels such as 20%, 30%, 50%, 70%, and 80%. In the middle you will see Short BCH vs [asset] with columns for contract choices such as 5x/5x, 5x/2x, 3x/3x, 2x/5x, and 2x/2x. On the right you will see Long BCH vs [asset] with the same contract choices. The rows show common expiries such as 1 day, 3 days, 7 days, 14 days, 30 days, 60 days, 90 days, and 180 days.

Every cell displays the current premium as a percentage for that contract choice and expiry. Green means a negative premium where you receive BCH when opening the position. Red means a positive premium where you pay to open the position. The shading indicates magnitude so deeper colors mean stronger premiums.

The header line above the tables shows the market name and the time the premiums were generated so you know how fresh the data is. Use these grids to spot green opportunities, compare across expiries, and see how the liquidity provider is moving in real time.

If you like a premium with a specific set of parameters, you can simply click on that premium and it will open the BCH Bull app with those exact contract settings automatically loaded for you. This lets you move from analysis to action in one click.

How to interpret premiums and use them in your strategy

Green premiums are naturally attractive and unique to BCH Bull, as few platforms ever pay you to open a position. However, they are not always available, and they are not the main goal in every situation. The real value lies in understanding how premiums move, timing your entry, and using them to read market balance rather than simply chasing green numbers.

For traders, it is important to remember that large or highly leveraged positions, such as a 7.77x long, will almost always carry a red premium. This reflects the fact that you are receiving fully collateralized, on-chain leverage instantly. The red premium is the cost of entering a strong, guaranteed position with no waiting, no margin calls, and no counterparty risk. The goal is not to avoid it completely, but to enter at a moment when the overall market context supports your strategy.

For hedgers or those seeking on-chain stability, green premiums are a welcome bonus, but not the only factor. Sometimes a small red premium is entirely worth paying for the peace of mind that comes from having a decentralized, transparent, and trustless hedge in place. The key is to weigh timing, protection, and convenience together rather than viewing the premium alone as good or bad.

By tracking premium movements across the tables, you can learn to recognize shifts in liquidity and sentiment. Over time, this helps refine both your trading entries and your hedging decisions, giving you a clearer understanding of when to act and what the premium is really telling you.

Tracking trends in premiums

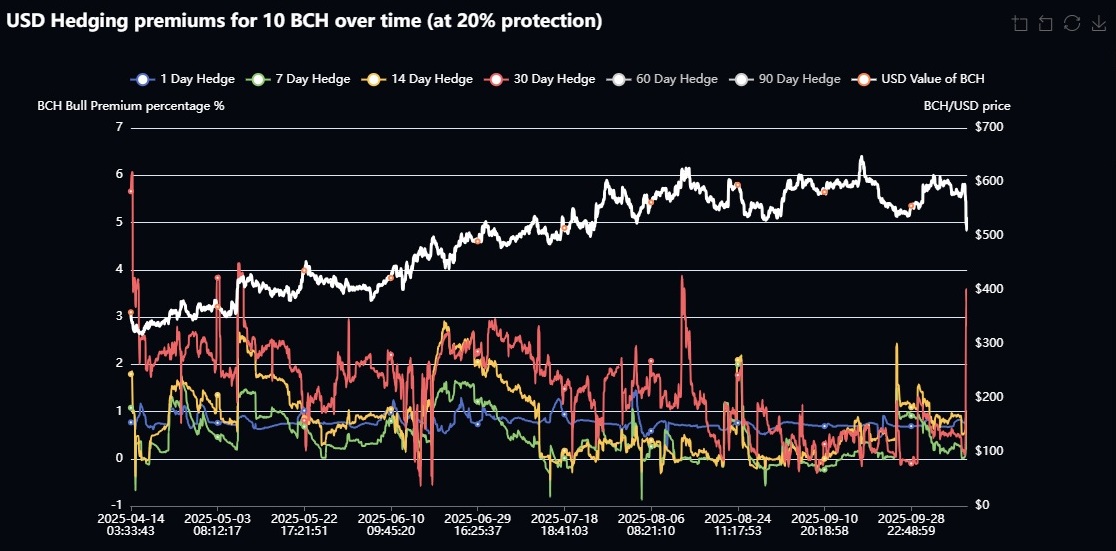

Some savvy BCH Bull users are already tracking premium trends to gain deeper insight into market behavior. Charts like the one below monitor premium percentages over time for fixed-size positions, such as a 10 BCH hedge against USD, showing how premiums rise and fall with market conditions.

These charts help traders and hedgers focus their attention on the flow of liquidity and sentiment rather than just price alone. By observing how premiums react across different durations and market phases, users can time their entries more intelligently and recognize when conditions may be shifting in their favor.

This kind of trader-led analysis is already proving useful, and as BCH Bull continues to grow, it is possible that more advanced tools and visual trend tracking could appear in the future. For now, keeping an eye on live premium data is one of the most insightful ways to understand how the BCH Bull markets are evolving.

Putting it all together

Premiums on BCH Bull are simple, visible, and locked at the start of each contract. Fees are a cost you always pay. Premiums can be either red when you pay or green when you receive, and you see the exact value before you confirm.

Unlike many DeFi platforms with shifting funding rates and moving targets, BCH Bull gives you a clear entry point. Your premium does not change after creation, so you always know where you stand.

Use the Premiums Tables to spot opportunities, compare expiries and setups, and time entries. Green premiums are a bonus when available. Red premiums are the cost of instant, fully collateralized, on-chain leverage or peace-of-mind hedging.

Build a habit: check live premiums, pick parameters that fit your plan, and act with clarity. Over time, you will read the premium movements as signals of liquidity and sentiment, which helps both traders and hedgers make better decisions.